In the ever-evolving landscape of cryptocurrencies, mining remains one of the most enticing yet challenging avenues for generating profits. However, not everyone has the luxury of setting up sprawling mining farms in their garages or renting expansive warehouse spaces. This is where hosted mining services come into play, offering both novice and seasoned miners an opportunity to participate without the logistical headaches. But the question lingers: how do you precisely calculate the returns from hosted mining, especially when dealing with volatile assets such as Bitcoin, Dogecoin, or Ethereum?

At its core, hosted mining means leasing out your mining hardware to a third-party operator who handles the maintenance, electricity costs, and cooling necessary to keep the rigs running efficiently. This arrangement allows investors to focus solely on the financial returns instead of the technical and physical burdens associated with mining. Despite this convenience, profitability is anything but straightforward. It requires a careful examination of multiple variables including hash rates, mining difficulty, electricity expenses, pool fees, cryptocurrency price fluctuations, and the hosting company’s service charges.

Bitcoin mining, the pioneer activity in the digital mining arena, operates on the Proof of Work consensus algorithm, which makes computational power king. Miners—or mining rigs, specialized machines optimized for solving cryptographic puzzles—compete to hash blocks the fastest and earn block rewards plus transaction fees. When using hosted mining, the hash power you lease translates directly to your share of the mining rewards. However, as Bitcoin’s network difficulty adjusts roughly every two weeks to maintain a ten-minute average block time, your income potential can swing dramatically. Therefore, to get a realistic estimate of returns, miners must keep an eye on current network difficulty, hash rate, and expected BTC price.

On the altcoin spectrum, Ethereum mining remains prominent, especially before the full transition to Ethereum 2.0’s Proof of Stake. ETH mining relies heavily on GPUs and specialized rigs optimized for the Ethash algorithm. Hosted mining providers offering Ethereum rigs often deliver high hash rates, but energy consumption and network difficulty factors must be analyzed closely. Unlike Bitcoin, Ethereum’s economic model also includes ‘gas’ fees which can add subtle layers of profit or loss beyond simple block rewards. Planning returns involves monitoring these fluctuating fees, currency prices, and power costs embedded in hosting contracts.

Indubitably, Dogecoin serves as an intriguing example of popular memes converging with serious mining economics. While Dogecoin mining can be merged with Litecoin on a merged mining base, hosted mining for DOGE typically appeals to those looking for diversified crypto exposure with relatively lower difficulty levels. Sophisticated hosted miners offer packages that bundle DOGE mining with other coins to hedge against market volatility and maximize cumulative rewards. Assessing returns in this sector entails understanding merged mining efficiencies, the evolving Dogecoin network hash rate, and market liquidity on exchanges for trade or stake.

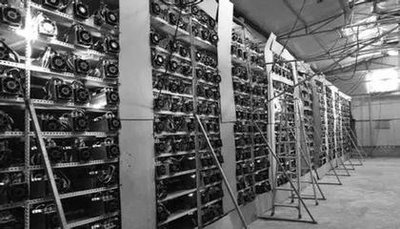

Mining farms—the physical embodiment of pooled mining power—represent the scale and scope of modern cryptocurrency infrastructure. These farms house thousands of miners, each contributing to a collective hash rate. When investing in hosted mining within such farms, transparency from the operator about uptime, operational costs, and energy sourcing becomes paramount. Renewable energy integration, for instance, not only reduces the ecological footprint but can drastically affect electricity expenses—a major cost center impacting profitability. Returns from hosted mining are thus intricately tied to the hosting environment’s operational excellence and sustainability practices.

Miners themselves—those individuals or entities deploying mining rigs—face a dynamic puzzle: balancing capital expenditure with variable operating costs and market swings. In hosted mining arrangements, miners essentially convert fixed hardware costs into a contractual monthly or yearly fee. This trade-off offers the benefit of predictable expenses but can limit upside potential during bullish markets. Calculation tools that factor in daily mining rewards, pool deductions, hosting fees, and anticipated coin price trajectories provide the most reliable forecast of returns. It’s vital to incorporate scenarios with fluctuating network difficulties and fee structures to ensure resilience against adverse conditions.

Modern mining rigs push computational boundaries further every generation, boosting hash rates while striving for energy efficiency. Hosted mining companies upgrading their rigs—from legacy ASIC miners to latest-gen models—directly influence client returns through enhanced performance metrics. Buyers should inquire about the specific models deployed in hosting services, their hash rates, and power usage efficiency measured in joules per terahash (J/TH). This technical insight assists in assessing relative cost-effectiveness, helping investors decide when to switch between hosting providers or mining different cryptocurrencies.

Beyond the machines and infrastructure, exchanges play an indispensable role in mining profitability. Miners convert mined cryptocurrencies into fiat or alternative coins via exchanges, incurring fees and timing risks. Exchange liquidity, withdrawal limits, and trading pairs influence how swiftly miners can realize profits or rebalance portfolios. For hosted mining customers, choosing providers with integrated, low-fee exchange partnerships can streamline operations and enhance net returns. Additionally, some platforms offer direct payouts in stablecoins, shielding miners from sudden price drops while maintaining steady cash flow.

In conclusion, calculating your returns from hosted mining is a multifaceted exercise is a dance navigating technology, economics, and market psychology. By comprehensively understanding hash rates, mining difficulty, hosting costs, currency price dynamics, and associated exchange mechanisms, investors can craft realistic profit projections. Hosting mining machines frees participants from operational burdens, yet requires vigilant financial modeling and continuous market observation. Harnessing these insights empowers miners to unravel the true profit potential hidden within the cryptographic algorithms that secure the decentralized future.

A crucial guide! Demystifies hosted mining ROI with practical calculations. Beyond hype, it delivers tangible insights for maximizing profit and minimizing risk. Essential reading.