As the cryptocurrency market continuously evolves, so does the technology and profitability surrounding mining. With the emergence of ASIC miners and the dominance of coins like Bitcoin (BTC) on specialized hardware, one might wonder: is GPU mining still a viable endeavor in 2024? This question touches on multiple facets, from fluctuating coin prices and mining difficulty to energy costs and the advances in mining rig setups hosted in professional mining farms. The answer isn’t straightforward but layered, driven by market dynamics, hardware capabilities, and the diversity of cryptocurrencies available for mining.

GPU mining originally surged in popularity during the early days of cryptocurrencies like Ethereum (ETH), where the coin’s algorithm favored the parallel processing capabilities of graphics cards. Unlike Bitcoin, which heavily relies on ASICs (Application Specific Integrated Circuits), Ethereum’s Ethash algorithm was designed to resist ASIC dominance and favor GPUs. However, with Ethereum’s transition to Proof of Stake (PoS) in its recent network upgrades—effectively phasing out mining—mining ETH with GPUs has lost its appeal, raising questions over the future of GPU mining sustainability.

Still, the cryptocurrency ecosystem is vast, with numerous altcoins thriving and requiring GPU mining rigs. Coins like Ravencoin, Ergo, and Flux continue to use algorithms suited for GPUs, presenting opportunities for miners to capitalize on diverse markets. Staying updated on the profitability charts across mining pools and exchanges is essential for miners who wish to pivot between coins to maximize returns. Services that bundle hosting and maintenance for mining machines offer an appealing prospect, reducing the overhead of electricity cost management, cooling solutions, and hardware upkeep.

Hosting mining rigs in professional mining farms integrates economies of scale, specialized infrastructure, and grid management, creating an environment where miners’ returns can be optimized. This model is particularly attractive for small to medium-scale miners looking to circumvent the bottlenecks of electricity and heat management that come with at-home setups. Moreover, mining farms frequently reinvest profits to upgrade their Miner fleets, combining ASICs and GPUs to tap into different chains. Careful asset allocation and timely shifts toward profitable coins are key to maintaining steady cash flow in such complex operations.

Bitcoin mining remains a behemoth, with its ASIC miners outperforming GPUs fundamentally. The mining difficulty and network hash rate have reached astronomical levels, making GPU mining for Bitcoin next to impossible. However, GPU miners often turn to Dogecoin (DOG), which shares merged mining capabilities with Litecoin and uses a scrypt algorithm, or other emerging tokens. These coins’ dual nature—both mineable via GPUs and integrated with broader decentralization objectives—can provide solid secondary incomes when paired with strategic trading on exchanges.

Furthermore, swapping profits between mined coins and their exchange counterparts allows miners to hedge against market volatility. This adds a layer of complexity but also flexibility, as miners can mine one coin today and exchange it for another cryptocurrency with higher short-term value or hold for long-term gains. Platforms with low fees and efficient transaction processing like Binance or Coinbase have become crucial in this cycle, enhancing real-time decision-making based on the market’s ebbs and flows.

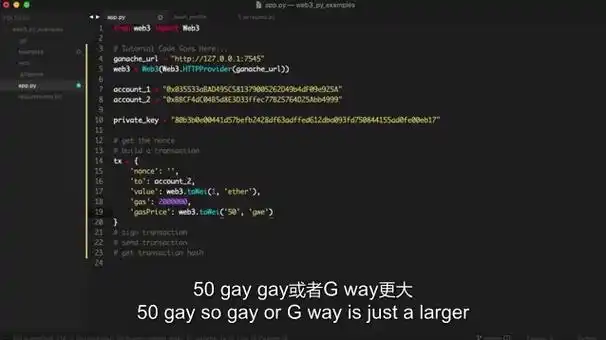

The rise of decentralized finance (DeFi) and the expansion of Web3 also indirectly affect GPU mining profitability. Coins that underpin decentralized applications offer potential mining opportunities, especially as some networks adopt hybrid consensus mechanisms that still reward miners alongside validators. For instance, Ethereum Classic (ETC)—a fork of ETH that retains proof-of-work—continues to attract GPU miners despite the original Ethereum moving away from mining. These opportunities, albeit niche, illustrate that GPU mining’s future depends heavily on specific project ecosystems and their consensus mechanisms.

Energy efficiency remains a decisive factor. Newer GPU models considerably reduce wattage per hash rate, yet electricity costs can still dominate operational expenses. Miners who secure low-cost renewable energy or negotiate favorable hosting contracts improve their margins significantly. Environmental concerns and regulatory scrutiny further push the industry toward greener and more sustainable mining practices, including enhancing mining rig designs to optimize airflow and reduce thermal waste.

To conclude, the profitability of GPU mining in 2024 is not an all-or-nothing scenario—it’s nuanced and dependent on several interconnected variables. While it may no longer be lucrative for traditional giants like Ethereum or Bitcoin miners, diversified approaches targeting emerging coins, optimized hosting solutions in mining farms, and savvy asset management strategies on exchanges present viable pathways. For companies involved in selling mining machines and providing hosting services, educating clients about these trends and encouraging flexible, data-driven mining strategies is paramount to thriving in a rapidly shifting landscape.

Mining profitability in 2024 depends heavily on electricity costs and coin prices. This analysis likely explores specific GPU models, algorithm efficiency, and alternative crypto options, offering a nuanced profit outlook.